Earlier this summer, the Altimeter Group and WetPaint collaborated to produce the ENGAGEMENTdb site and related ENGAGEMENTdb Report ( a free download).

It’s truly a must-read if you’re interested in how large brands are engaging their customers through social media. In the Introduction, Ben Elowitz (of WetPaint) and Charlene Li (of Altimeter) claim:

While much has been written questioning the value of social media, this landmark study has found that the most valuable brands in the world are experiencing a direct correlation between top financial performance and deep social media engagement. The relationship is apparent and significant: socially engaged companies are in fact more financially successful.

So now we know it pays to be social, but it is important to note that by “social,” we’re talking about deep engagement, not merely having a presence.

But there’s an interesting rhetorical slip there – in the space between “a direct correlation between top financial performance and deep social media engagement” and “it pays to be social” we’ve crossed the gap between correlation and causation.

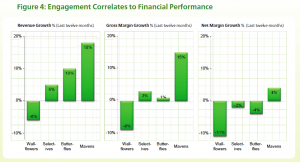

First, the correlation, which is well encapsulated in this set of graphs:

So it certainly seems that among their sample at least, the companies which are the most engaged – the Mavens and the Butterflies – are experiencing consistently better financial performance (as revenue and as gross margin) than the least engaged – the Wallflowers and Selectives.

But does this mean that “it pays to be social”? Are the most engaged brands financially successful as a result of their engagement in social media? Are the most financially successful brands more likely to engage in social media (perhaps because they’ve got money to spend or at least less downward pressure on related budgets)? Or, perhaps, are high degrees of social media engagement and positive financial results BOTH correlated to some third variable not identified, like superior services and products, strategic leadership, corporate cultures of openness, or something else?

The reality is that based on the data presented in the study, we don’t know.

It may help to recall your first-year statistics class in college, and the correlation between ice cream sales and murder rates. Murder rates rise and fall in concert with ice cream sales, but that hasn’t lead to urban ice cream bans (at least not that i know of). Instead, the general theory is that both murder rates and ice cream sales are positively correlated with warmer weather. (Good summary here).

Am I suggesting that the Altimeter Group and WetPaint need to go back to first-year stats? No – they’re smart researchers and clearly understand the distinction, writing in the body of the report (page 7):

While these findings do not necessarily imply a causal relationship, they still hold powerful implications. Social media engagement and financial success work together to perpetuate a healthy business cycle: a customer oriented mindset stemming from deep social interaction allows a company to identify and meet customer needs in the marketplace, generating superior profits. The financial success of the company, in turn, allows further investment in engagement to build even better customer knowledge, thereby creating even more profits — and the cycle continues.

This suggests a more nuanced reading at once more accurate and less surprising. Companies taking the approach of ignoring customer feedback, and producing products and services without a deep understanding of what the market wants, are less likely to be successful. Similarly, and at the same time, companies who take some portion of the profits and invest in ongoing relationship with customers are more likely to continue to produce successful products.

Which, in fact, is exaclty what makes the report truly useful. The qualitative, best practices section, which covers Starbucks, Toyota, SAP, and Dell, is where the real value is.

Figuring out how your enterprise can leverage social media for business success is a process which requires significant customization to your industry, markets, products and services, brand legacy (or lack thereof), competitive landscape, financial state, and broader business strategy, but looking at the examples of highly engaged companies (who are also financially successful) is a good place to start.

5 Comments

Comments are closed.